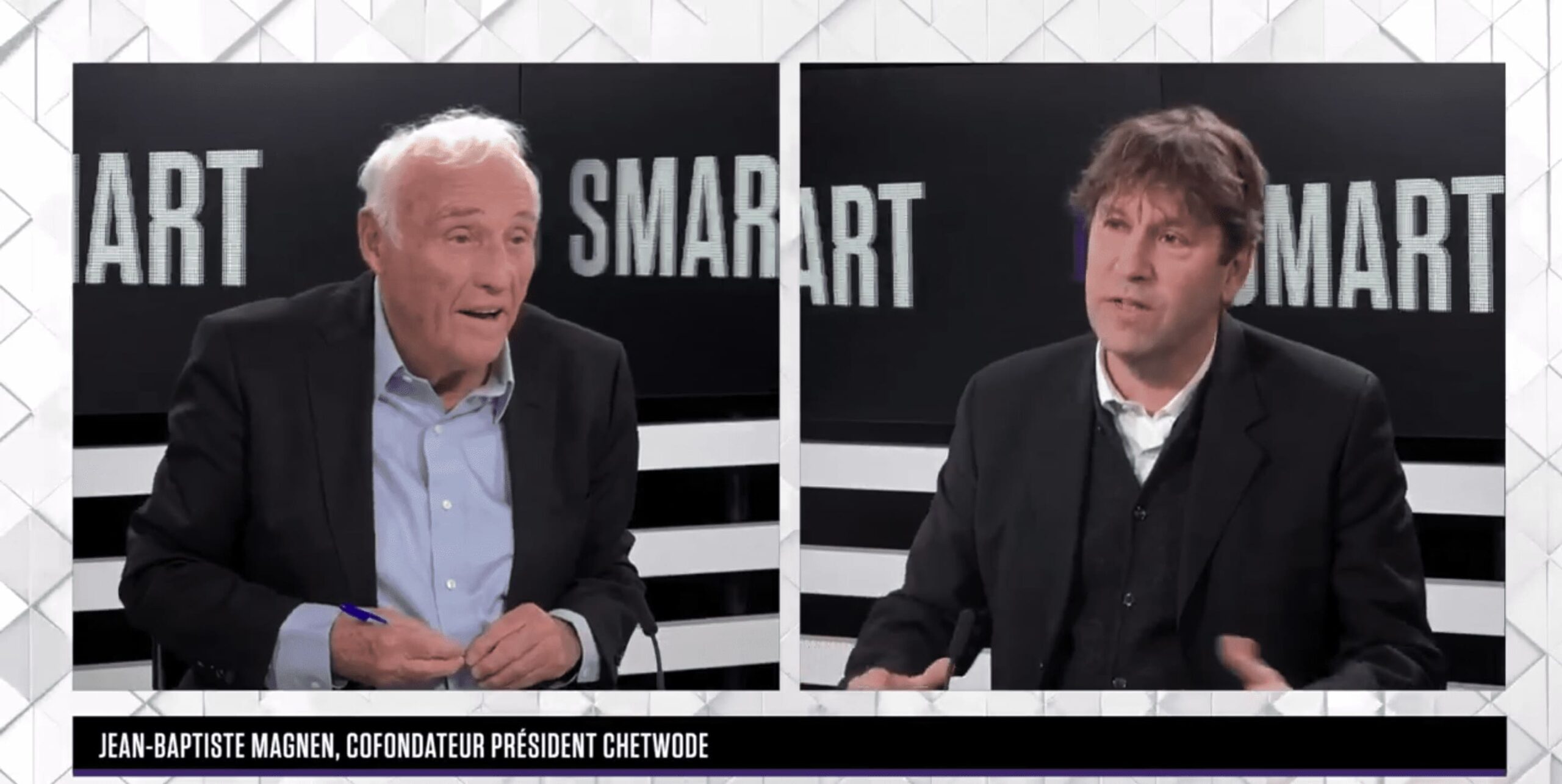

Chetwode, a specialist in alternative financing, has been helping companies to raise financing secured by their assets, mainly their production equipment, since 2003. You will find in this article the transcript of the interview with Jean-Baptiste Magnen in the programme Enjeux & Priorités of the B SMART channel, a news media specialising in the economy and finance. This interview was conducted by the economic journalist Jean-Marc Sylvestre. He was a journalist on TF1, LCI and i-télé (CNEWS today) before joining B SMART.

JBM: Yes, alternative financing complements bank financing. It is debt. We work a lot with industrial companies but also with other companies that have additional assets to offer as collateral, whether it be their machinery, their equipment, their stocks, sometimes even real estate.

JBM: We work with the free assets which can be either new or existing assets. We then have the option to buy them back or take them as collateral but they have to be free.

JBM: We are investment consultants. We help companies and we work with investment funds that are partners.

JBM: No. We are the ones who direct the funds but we are not the ones who grant the funds.

JBM: Yes, this has existed for a long time. We have systematised it in the field of industrial financing.

JBM: Yes, there are needs, especially since March 2021, especially since Covid.

JBM: 2020 was a completely sluggish year for us because either companies had no development project and therefore no financing project or they had PGEs (state guaranteed loans). Today, companies have new growth projects and therefore need to raise financing.

JBM: We bring our understanding of the needs of large SMEs and ETIs. We bring our network of financial partners. We work in partnership with debt funds and we bring our 15 years of experience.

JBM: We have set-up commissions when the financing is put in place, fees and afterwards, according to the investment funds, on the follow-up of the financing projects (we have in-house technical experts who go to the companies to check on the good state of maintenance…).

JBM: The company was created by French and English partners. It’s an English name. A mansion near Oxford.

See the interview with Jean-Baptiste Magnen in the programme Enjeux & Priorités on B SMART, a news media on the economy and finance.