Sale and leaseback is a financial solution that is gaining ground in France. This solution is advantageous for companies looking to raise cash. It allows companies to sell their assets to an investor while continuing to use them under a lease agreement. This type of financing not only improves cash flow, but also allows you to concentrate on your core business. In this article, we’ll look at the definition of (sale and) leaseback, the advantages of this solution and, finally, who it’s for.

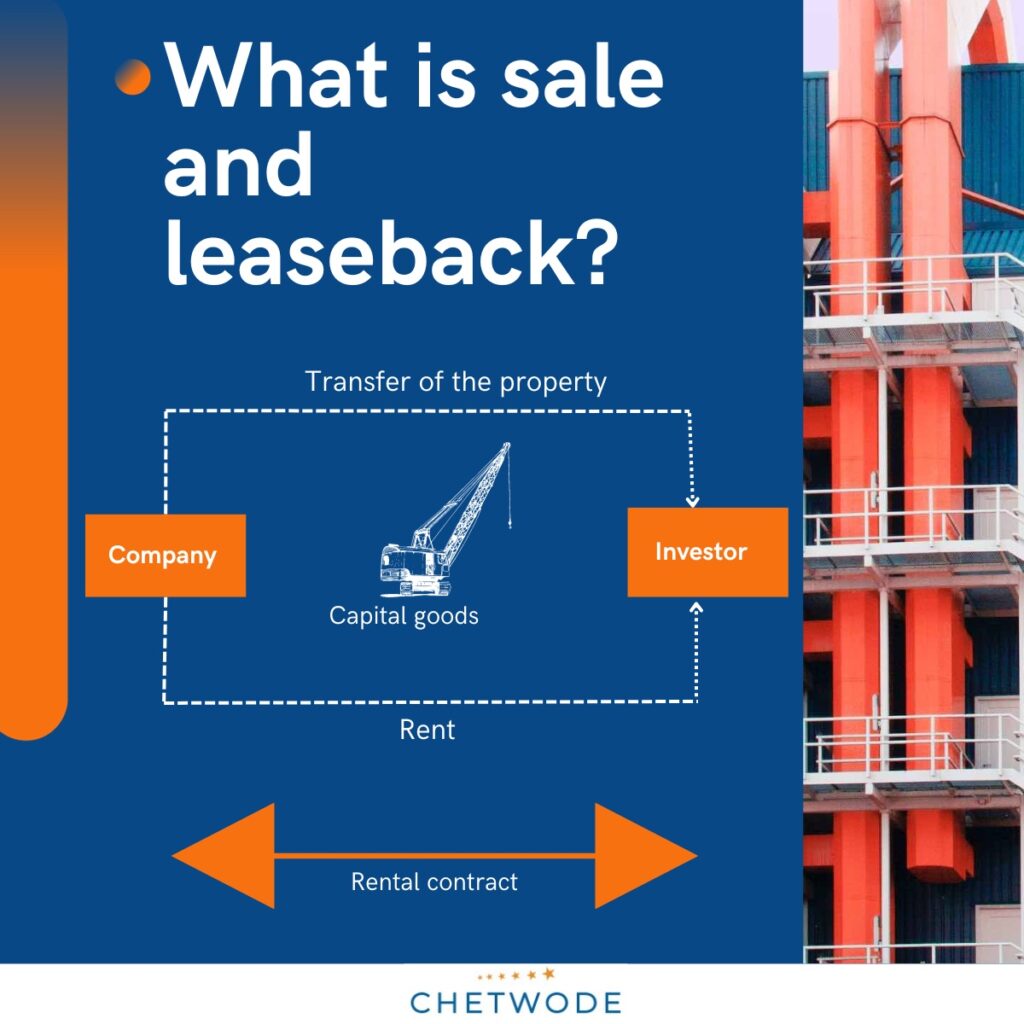

Sale and leaseback is an arrangement in which one party sells one or several equipment items to a buyer who then immediately leases the property back to the seller for an agreed period. The seller continues use his production equipement and pays lease rentals.

Does your company own production equipment? Do you wish to generate liquidity in order to finance a development project? Sale and leaseback allows yout to use your production equipment as a real tool for growth, providing immediate liquidity for you to implement your investment projects.

Recent years have seen a substantial credit crunch resulting in banks imposing tighter credit conditions. As a result, many SMEs and intermediate size companies who traditionally turned to bank credit (intermediated financing) to finance their development, suddenly got deprived of their main source of long-term financing.

In this favourable climate for disintermediated financing, alternative financing solutions such as sale and leaseback appear to be a real answer to credit crunch, by assisting companies in the refinancing of their industrial equipment in addition to or replacement of traditional credit lines.

«Sale and leaseback follows a case-by-case logic by financing equipment items that are core to companies’ activity», explains Jean-Baptiste Magnen, Chetwode President. «This is a practical approach with expert equipment brokers who are highly specialised and able to find value on old equipment items».

The implementation of a sale and leaseback transaction relies on a tri-criteria analysis:

This innovative reading of a business specific to sale and leaseback, is based upon a dual approach (Corporate and Equipement). It allows the possibility of providing financing to any kind of business. The « asset risk » analysis and the specific structurating of leasing contracts allow the transaction risk to be balanced with the lessee’s credit risk, especially for companies with complex credit stories.

However, this type of financing is not exclusively meant for companies facing difficulties. On the contrary, some leading names in industry like Chargeurs Group or Arc International have been using sale and leaseback to support their growth and diversify their financing sources.

More recently, the automotive subcontractor MBF Aluminium and the Spanish tissue paper manufacturer Cominter Group, have sought a sale and leaseback financing (respectively 7.25M€ and 6.3M€), to modernise their processes and finance their growth.

Industrial SMEs and intermediate size companies are the major beneficiaries of these new disintermediated financing tools, such as sale and leaseback, that are perfectly adapted to substantial investments into production lines for example. By supporting investment strategies and growth projects of SMEs and intermediate size companies, sale and leaseback lies at the very heart of the economic fabric and actively contributes to industrial development.

In conclusion, sale and leaseback is a solution that offers many advantages for industrial companies, in particular by helping them to free up funds while continuing to be able to use their assets. This strategy also allows companies to focus more on their core business.

However, this type of financing can be complex, particularly as it involves the upstream recovery of equipment that may sometimes be old or worn out, so it is advisable to carry out an in-depth study in order to obtain the most effective options. Chetwode has specialised in sale and leaseback since 2009. Contact us, we’ll be happy to help.