Financing an industrial asset: the 7 key steps in a financing study process

Is the acquisition of industrial assets (machinery, buildings and equipment, etc.) a strategic growth lever for your company?

Is the acquisition of industrial assets (machinery, buildings and equipment, etc.) a strategic growth lever for your company?

The building and public works sector is an industry that requires considerable investment in equipment and infrastructure.

When it comes to financing a project, the size of the amount to be financed can have a significant impact on the way it is managed.

Would you like to finance a movable or immovable asset to develop your industrial business while preserving your cash flow and having the option of purchasing the asset?

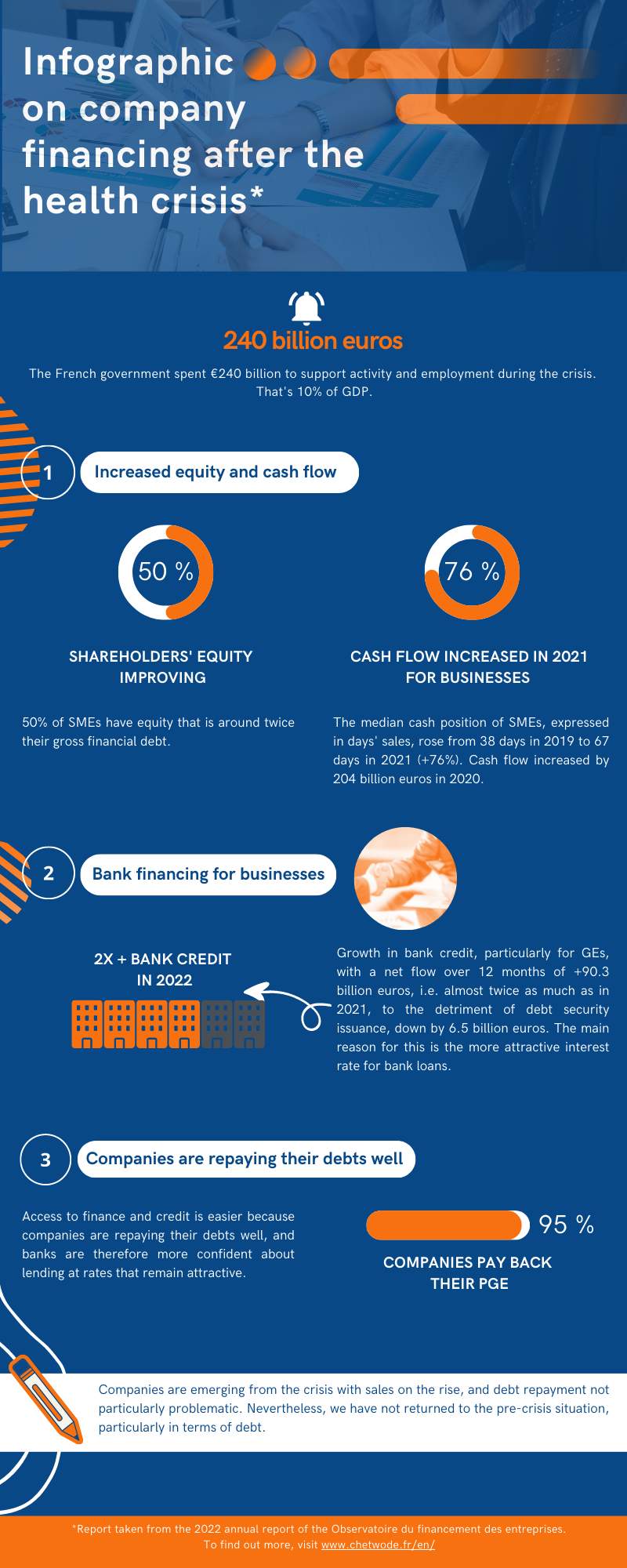

Did you know that the French government spent no less than €240 billion to support business and employment during the health crisis?

Your stocks and equipment represent a real financing solution for your business. But are you really making the most of your assets to develop your business?

Did you know that your stock, a strategic tangible asset, is a powerful financial lever for the development of your company?

Digital transformation and the green economy represent an opportunity to bring a new industry to France. The current bill on green industry, which will soon be defended by the government, is essential for the future of France.

Debt funds are taking away part of the corporate finance market from banks. Indeed, we have seen a significant change in the financial world in recent years.

Did you know that today servicisation is at the heart of industry and has even become almost imperative. INSEE has observed that 80% of industrial companies already offer services in addition to their traditional offer.