Do you want to invest in your company? Take advantage of your tangible assets to ensure its development.

These include buildings, machines and stocks. Some of these tangible assets are strategic because they play a key role in manufacturing. At Chetwode we offer you this expertise and a financing offer based on it. In this article, we have chosen to highlight industrial equipment, and we will soon be producing an article on strategic stocks.

Christine Wiart, Back and middle office manager at Chetwode, explains in this article what tangible assets and strategic tangible assets are and how to value your equipment in the context of financing.

Tangible assets are physical, palpable assets, what you see in your business on a daily basis, these can be :

It is interesting to identify their strategic nature for the company: are they tangible assets without which the business is compromised?

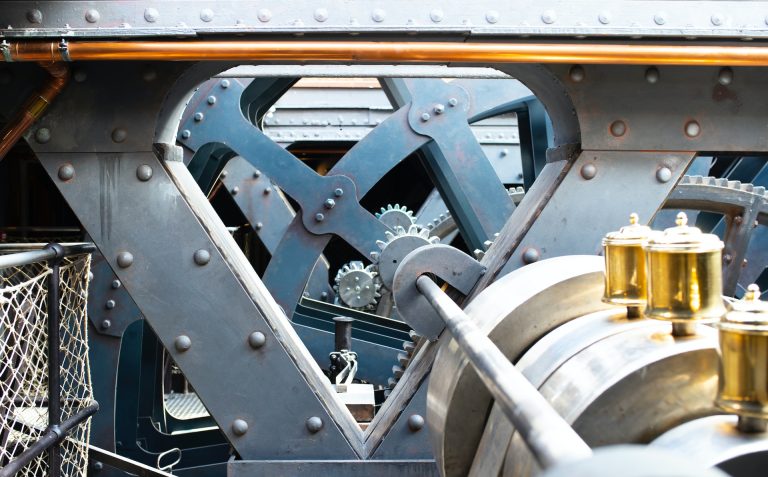

Let’s take the case of industrial equipment. Strategic machines are part of the main production cycle of an industrial company. They are all the more so because they have been adapted to its needs, or custom-built, sometimes even inseparable from the buildings that house them. This specificity makes the machines more difficult to replace, dismantle and resell because of their strategic nature, the maintenance and insurance of this equipment are essential to ensure the continuity of production.

Strategic equipment is of interest to investors, who can offer financing against it if it is owned by the company (so-called unpledged assets or assets without reservation of ownership in the case of stocks).

A resale value is determined and on this basis a financing amount can be allocated. After signing a sale and leaseback agreement, the investor becomes the owner of the equipment and can dispose of it for resale in the event of the company’s default.

Another interesting area of our expertise is the revaluation of assets to improve the presentation of the company’s balance sheet. This practice benefits from an advantageous tax framework, thanks to the multi-year deferral of the capital gains generated.

At Chetwode, our experts can value your industrial equipment, in Europe and beyond. On the basis of the report produced, we arrange financing through our network of investors, to cover needs up to €50 million. If you would like to know more about our solutions, we look forward to hearing from you.

Christine Wiart is back and middle office manager at Chetwode since 2016. She worked at Warner Lambert for 5 years and then for 13 years at Sanofi as a purchasing manager. She is a graduate of the Institut National Agronomique Paris-Grignon and has a Master’s degree in purchasing from Essec Business School.