Offshore private credit on the European market and its relevance to South African and international investors

Podcast Fedgroup of Offshore private credit.

Podcast Fedgroup of Offshore private credit.

Is the acquisition of industrial assets (machinery, buildings and equipment, etc.) a strategic growth lever for your company?

The building and public works sector is an industry that requires considerable investment in equipment and infrastructure.

When it comes to financing a project, the size of the amount to be financed can have a significant impact on the way it is managed.

A pledge is a legal instrument used to secure a debt to ensure payment to a creditor.

Today, many SMEs with sales of less than 50 million do not have enough equity capital.

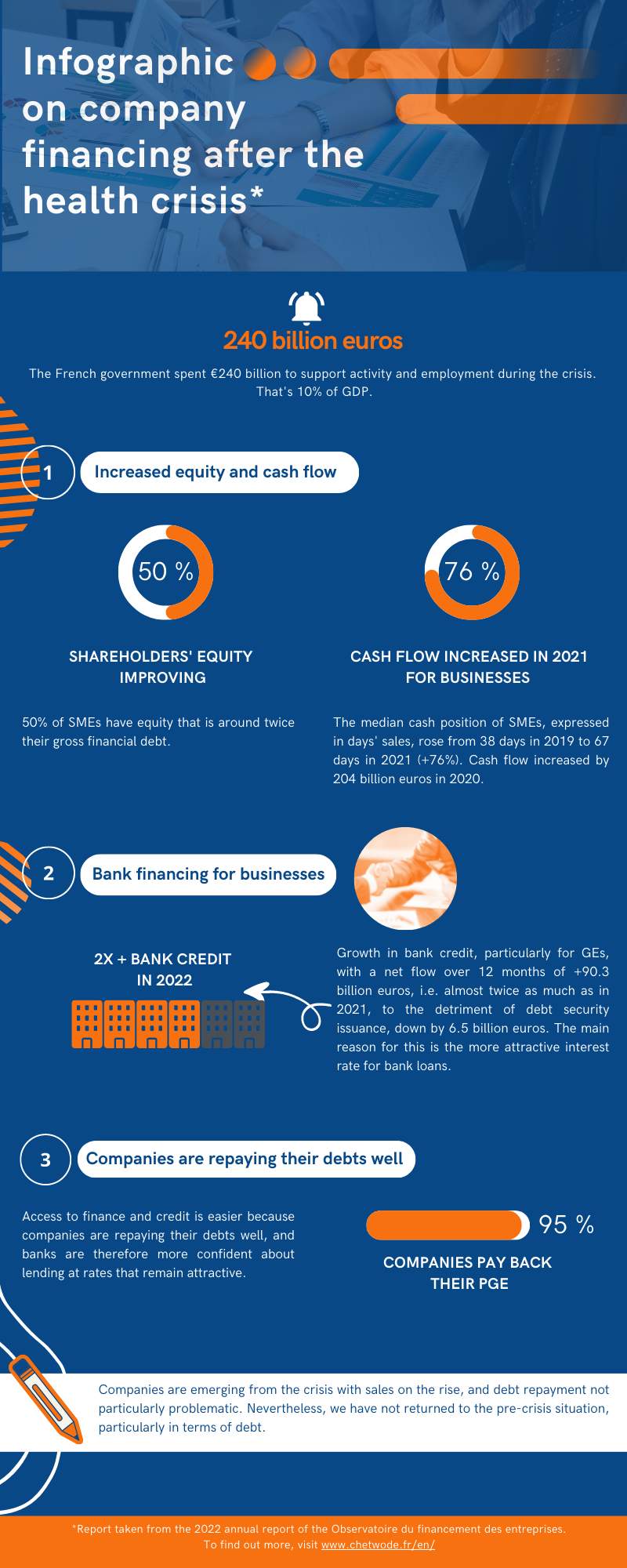

Did you know that the French government spent no less than €240 billion to support business and employment during the health crisis?

Your stocks and equipment represent a real financing solution for your business. But are you really making the most of your assets to develop your business?

La transformation digitale et l’économie verte représentent une opportunité de faire venir une nouvelle industrie en France. L’actuel projet de loi sur l’industrie verte, qui va bientôt être défendu par le gouvernement, est essentiel pour l’avenir de la France.

The joint venture is the preferred solution for companies wishing to develop a market in a new country. In addition, it can also be an asset for manufacturers who wish to combine their various leasing contracts into a single structure.