Does the acquisition of industrial assets (machinery, buildings and equipment, etc.) represent a strategic lever for growth for your company?

This purchase often requires a complex financial package. This financing study process can take several months and sometimes even up to a year. Poorly prepared financing can lead to delays, additional costs or even rejection by investors. It is therefore essential to get your project right from the outset, validate its feasibility and present it convincingly to investors.

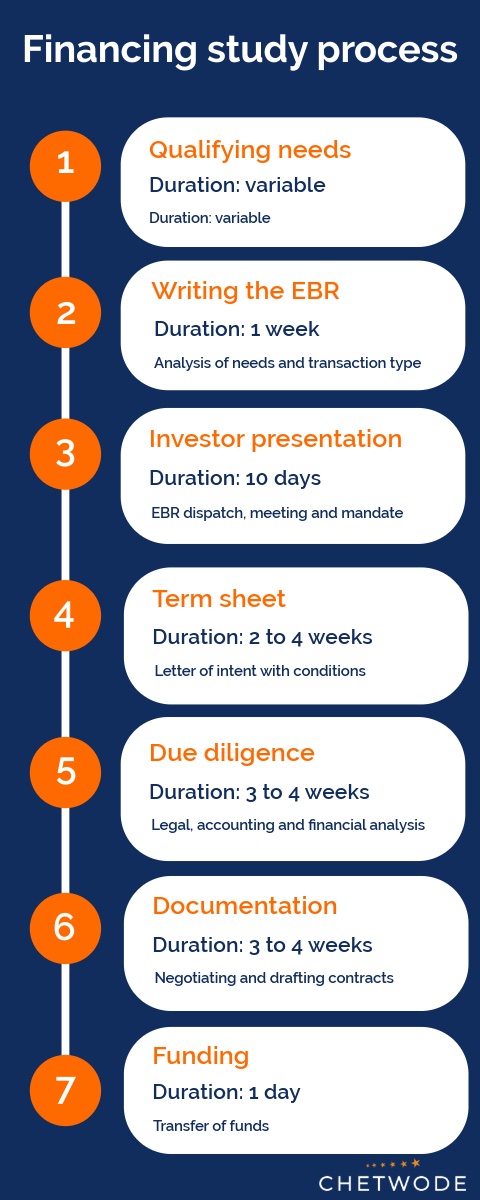

Chetwode, with its 20 years’ experience in financing industrial assets, has established a sequenced 7-step process to efficiently support industrial companies in their search for debt investors.

In this first stage, we analyse the needs of the industrial company, taking into account its size, sector and strategy.

This first stage involves our teams gaining an initial understanding of the company’s financing requirements. This involves discussions with the company to understand its business, its dynamics and that of the market in which it is involved. We also discuss the assets that will form the collateral (guarantee) for the financing sought.

We assess the suitability of the financing, particularly in terms of the company’s repayment capacity, and the attractiveness of the assets to investors.

After identifying the company’s needs, our teams draw up an Executive Business Review. The EBR is a summary document of no more than ten pages (4 to 10) that gives the investor an understanding of the company, its financing requirements and the type of transaction proposed.

The EBR contains :

This document enables our investor partners to quickly decide whether or not they are willing to look further into the project.

As soon as an investor expresses an interest in studying the deal in more detail, a financing mandate is signed and an initial meeting is organised between the customer, Chetwode and the investor. This first meeting provides an opportunity to explain the investors’ initial questions, in particular the explanation of the financial situation and the various financial ratios, as well as the positioning and strategic context of the company. This first meeting provides an opportunity to review the investors’ initial questions, and in particular to explain the financial situation and the various financial ratios, as well as the positioning and strategic context of the company.

The term sheet (‘terms and conditions’) is an indicative letter of interest issued by the investor setting out the main conditions and characteristics of potential financing. If accepted, this indicative offer (signed by the parties) will provide a framework for future discussions.

The indicative letter of interest specifies in particular :

This stage follows the signing of the Term Sheet and involves a legal, accounting and financial audit of the project. It is used to secure the investor’s decision and confirm the conditions set out in the Term Sheet previously issued.

It covers (but may not be limited to) :

The company’s figures are questioned in order to analyse whether it will generate enough cash per year to be able to repay the loan.

Once the audits have been completed, the lawyers on both sides draw up the final legal documentation. This stage makes it possible to adjust certain parts of the contracts according to the results of the audits, and may allow certain financing conditions to be renegotiated if the audits provide sufficient comfort to the investors.

Once the documents have been signed, the investor disburses the funds in accordance with the agreed terms. In general, the two processes take place at the same time, but depending on the nationality of the lender and the legal structure put in place, disbursement can take between 1 and 10/15 days.

In conclusion, this asset finance review process is a comprehensive approach that enables industrial companies to achieve the best possible financing with Chetwode.

Thanks to this process, our industrial customers can:

Chetwode offers industrial companies its expertise in financial structuring, legal coordination and financing engineering, as well as its extensive network of investors in France and abroad.

If you have any questions, we will be delighted to help you. Please do not hesitate to contact us.